Source: Lew Rockwell

Source: Lew Rockwell

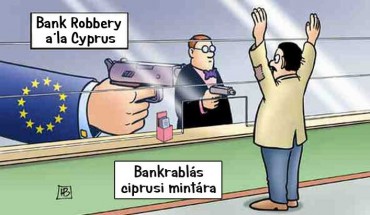

Who may have missed the notification, it helps to know that you have seen in Cyprus bailout method in other countries will soon come into force.

The G-20 member countries (including the EU) is an important decision was taken on November 16. The world's mega banks are entitled to the depositors' money is used as collateral derivative transactions, and if they lose, the fuse will regard the transaction partner.

The governments of the G20 countries are obliged by law to overcome critical agreement with what most of us have already been completed.

Excusable, if someone did not pay too much attention to the G20 meeting, since roughly the continued what they started earlier, namely, that the central bank a few trillion dollars / euros are injected into the global economy.

However, the meeting adopted a proposal was wearing: a decision on the global systemically important banks veszteségnyelő ability to comply with the requirements. Not the kind of reading that a man can not put down. The average reader is more likely to have been the sight of the title, the proposal is fundamentally changes the rules for banks all over the world, and, as expected, is not a good direction.

The change as a result of "unsecured debts" capitalized on the fail-too-big-banks deposits, eliminating the ugly and extremely unpopular with the public, bank rescue financed by taxpayers' money that will be used during the 2008-2009 financial crisis.

These unsecured debts will make up a significant portion of our bank deposits. Insolvent banks thus the conversion of securities and bank deposits, we capitalized on themselves. So now, when we make money in the bank, we take the same risk as if we buy shares. But we could say is that as soon as the horse would do the Shooting Star Kincsem park, this is essentially because the banks do with our money.

The G20 meeting also decided that the derivatives - contracts are toxic, what Warren Buffett's "financial weapons of mass destruction" called - debt secured count.

Thus, since the bank deposits, unsecured debt is considered, by the bank as collateral for a secured creditor, guess to who gets the money if the bank's investment goes wrong? I'll help you: not yours.

Heads or tails? If heads, the bank wins, tails, you lose it.

Fortunately, the "insured deposits" does not apply. In the United States, for example, 100 percent of the insured deposits held in banks protected up to $ 250,000 due to the federal deposit insurance, but the insurance fund as a reserve ratio is below 1%. So all the FDIC to $ 100 less than one dollar coverage is in reality.

This is still quite a lot of money, which was 54 billion dollars at the end of September 2014, but nevertheless is dwarfed in comparison to the value of $ 6,000 billion in insured deposits, not to mention the derivative contracts worth a total of nearly $ 300,000 billion. Only Wall Street bank's collapse would be enough to exhaust the full insurance coverage.

US laws allow the Treasury to supplement the missing amount, at the time of the banking crisis csőstül trouble coming. Many will stand in line for money, including those who are likely to have better political relations with us, than the average citizen.

And how it looks in reality? Scenario adopted by the G20 under the non-insured bank deposits would be worse off than the Cypriot state bank account holders in 2013, when Cyprus became insolvent. His claims were favored with respect to the derivative transaction partners. Was returned to each depositor is not provided half the money (though nothing were in one of the state-owned bank).

And how it looks in reality? Scenario adopted by the G20 under the non-insured bank deposits would be worse off than the Cypriot state bank account holders in 2013, when Cyprus became insolvent. His claims were favored with respect to the derivative transaction partners. Was returned to each depositor is not provided half the money (though nothing were in one of the state-owned bank).

Perhaps an even better example of Lehman Brothers situation. When the bank filed for bankruptcy in 2008, the unsecured creditors received 21 cents per dollar.

The man thinks about whether the G20 has been why such a decision. The most obvious explanation is that they want to avoid the politically unpopular bailouts in favor of the re-deployment of mega banks.

However, there is another, less obvious reason as well. The G20 hope that the people making government bonds provided by the Member States to invest more, causing most of the G20 countries currently characterized by alarmingly high rates would be reduced.

I do not know when it will break out following the global financial crisis, but it does mean that everyone in your wallet and mind. Not those of bankers and financial genius who invented the cause of their own downfall "financial weapons of mass destruction."

Nincsenek megjegyzések:

Megjegyzés küldése